The Ontario government recently introduced significant changes to the Ontario Student Assistance Program (OSAP) as part of a restructuring initiative aimed at making university and college more affordable for Ontario students while reducing the burden on taxpayers. The changes include a 10% tuition cut across all programs as well as a Student Choice Initiative that will allow students to opt-out of non-essential fees. Funding through OSAP will also be reduced with the changes, which include decreasing the amount of funding provided as grants and eliminating the 6-month interest-free grace period after graduation.

As expected, many students and advocacy groups are not happy with this move. While everyone acknowledges that tuition cuts are desperately needed, many still fear that the new OSAP restrictions will more than offset the benefits, forcing thousands of students out of school. This position is understandable, but upon closer examination, it seems to miss one crucial detail that is central to understanding the student debt crisis. Namely, student loans are the primary cause of skyrocketing tuition.

It may seem counter-intuitive at first, but the economics are really quite simple. As Ryan McMaken explains, when the government subsidizes education people will consume more of it, leading to an increase in demand and higher prices. Prof. Daniel Lin outlines the same argument, concluding that “instead of being helped by the subsidies, students are just taking on more debt than ever before.”

univSo although the changes to OSAP might be new, the economic insights that prompted them are certainly not. As far back as 1987, in a New York Times op-ed entitled Our Greedy Colleges, U.S. Secretary of Education William Bennett famously theorized that “increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would cushion the increase.” This argument came to be known as the Bennett hypothesis, and it has now been substantiated by multiple studies.

univSo although the changes to OSAP might be new, the economic insights that prompted them are certainly not. As far back as 1987, in a New York Times op-ed entitled Our Greedy Colleges, U.S. Secretary of Education William Bennett famously theorized that “increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would cushion the increase.” This argument came to be known as the Bennett hypothesis, and it has now been substantiated by multiple studies.

One study conducted by the Federal Reserve Bank of New York found that each additional dollar of subsidized loans causes colleges to raise tuition by about 60 cents. In his analysis of the study, Preston Cooper highlights an important takeaway. “Colleges are not exposed to risk should students default on their loans. Colleges are thus free to raise tuition with wild abandon, knowing that the financial burden will fall on students (or the government, should the students default). Generous student aid programs only accelerate this trend.”

The American National Bureau of Economic Research (NBER) also recently published a paper on this subject, entitled Accounting for the Rise in College Tuition. Alex Tabarrok outlines some of the key conclusions in his review.

“With all factors present, net tuition increases from $6,100 to $12,559. As column 4 demonstrates, the demand shocks – which consists mostly of changes in financial aid – account for the lion’s share of the higher tuition…These results accord strongly with the Bennett hypothesis, which asserts that colleges respond to expansions of financial aid by increasing tuition.”

Tabarrok also points out that “so much of the subsidy is translated into higher tuition that enrolment doesn’t increase! What does happen is that students take on more debt, which many of them can’t pay… the Econ 101 insight that subsidies increase prices holds true.”

It may be hard to believe that additional financial aid does little to increase enrolment, but the facts don’t lie. A recent report by Ontario’s Auditor General found that despite a 25% increase in the number of OSAP grant recipients for the 2017/18 academic year, “the increase in enrolment is only 1% for universities and 2% for colleges, indicating that the number of people accessing higher education is not commensurate with the additional OSAP funding.”

But even though the grants did very little to help enrolment, they certainly made it easier for universities to continue getting away with their tuition hikes, because that’s what happens when you subsidize students. Rather than making university more affordable, the expansive financial “aid” provided through OSAP has largely served to push tuitions through the roof, resulting in a system where many prospective students are “priced out of their local universities” through no fault of their own. It’s ironic, really, that a program specifically designed to increase the affordability of higher education has been overwhelmingly successful in doing the exact opposite.

Fortunately, it seems the government is finally catching on to the real impact of student loans, remarking in their news release that they are no longer interested in “using OSAP to indirectly subsidize future rounds of tuition hikes.” That little comment might not mean a lot to their detractors, but it is a clear and important nod to the Bennett hypothesis. It acknowledges that grants and loans often do more to enable higher tuitions rather than greater accessibility.

In the past, tuitions were low enough that you could work your way through college. But now, the fact that you can get generous student loans has led universities to set tuitions so high that you need to get generous student loans. So what we have here is a classic chicken and egg problem. More loans lead to higher tuitions, and higher tuitions necessitate more loans.

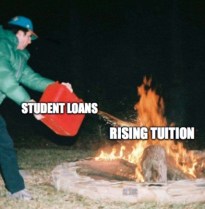

The result is an education system where costs are spiraling upward and student debt is exploding. And it’s no wonder students fear for their education. But the solution is not to beg the government for more money that will only serve to subsidize future rounds of tuition hikes. The solution is to hold universities accountable by reducing tuitions while capping the financial aid that has been providing fuel for the fire.

In light of this analysis, one has to wonder if the vitriol directed toward the government is really warranted. Not only are the OSAP cuts being described as “callous”, but the Student Choice Initiative is also coming under attack. Apparently, the idea that students should get to choose which campus initiatives they support is “a calculated attempt to dismantle the loudest and strongest advocates of public post-secondary education”. Even more, it has been compared to the “anti-union ‘right-to-work’ model”, because it “will encourage students to opt-out of students’ union dues and other student fees that the government has deemed non-essential”. And this is supposed to be a bad thing? If anything, students should welcome the freedom to keep more of their money. I find it hard to believe that organizations intent on promoting mandatory non-essential fees can honestly be in the students’ “best interest”.

Naturally, the biggest objections are around the elimination of the 6-month grace period and the reductions in the number of grants that will be offered. In fact, one article was so determined to demonize these changes that it neglected to mention the 10% tuition reduction. And while I understand that special interest groups will never appreciate funding cuts, I think it’s important that we look at the bigger picture. The fact is that you are already getting a very generous deal from the government, one that you haven’t exactly earned. And you need to understand that just because you want or need something does not mean that you are entitled to it. The government does not owe you an education. So rather than criticizing them for refusing to lavish you with taxpayer’s money, perhaps you should direct your anger toward the reason you need to take out the loans in the first place, which is the stupidly high tuitions.

You see, the real problem here is the universities and colleges, which have become accustomed to spending large sums of money on fancy new buildings and administrative bloat (as Daniel Mitchell outlines here, here, and here). So rather than facilitating an affordable education, programs like OSAP end up subsidizing a very luxurious one, all at the expense of taxpayers and the students themselves.

Of course, universities will complain about losing all of their “desperately needed” facilities and overpaid staff, but the reality is that the system is vastly inefficient and it’s about time they were forced to economize their resources. The solution to the student debt crisis is not to continue wasting billions of dollars on overrated educations with unnecessary frills. The solution is to hold educational institutions accountable for giving students a valuable education at a reasonable price. Students don’t need the ever-increasing tuitions that are enabled by programs like OSAP. What they need is an affordable education.

Latest posts by Patrick Carroll (see all)

- Ron Paul Revolution Takes Over The Libertarian Party - May 30, 2022

- How I Learned to Stop Worrying and Love Landlords – Opting Out - March 5, 2020

- Official Twitter Account Notice - July 6, 2022

- Secession: The Lost Aspect of Federalism - April 16, 2022

[…] Want to Make University Affordable? Stop Giving Out Student Loans. February 8, 2019. Being Libertarian. […]

Comments are closed.